Why gaming is the new Big Tech battleground | Financial Times Financial Times

Microsoft’s audacious $75bn move on games publisher Activision Blizzard has detonated a bomb under the games industry. Along with the proposed deal’s sheer size, the prospect of a tech giant worth more than $2tn making a grab for games industry leadership has prompted breathless speculation about whether it will precipitate a wider industry realignment.

According to some, the deal, announced on Tuesday, will greatly add to forces that have already been reshaping the sector in recent years including the streaming of games, leading to the creation of ever-larger gaming empires.

The huge size of today’s gaming audience, which already dwarfs other forms of mass-market entertainment, is playing to the strengths of companies that can build and manage giant online businesses to spread their costs, according to Bing Gordon, a longtime video game executive and venture capitalist.

“The new critical mass is bigger than ever,” he says. Comparing pressures building up in the games industry to the streaming video wars that are reshaping the TV and movie business, he adds: “Someone’s going to create a games service with hundreds of millions of subscribers.”

Satya Nadella, the Microsoft chief executive, meanwhile billed the planned acquisition as a step towards the metaverse — the name given to the virtual worlds that some of the biggest tech companies believe will represent the next big iteration of the internet. Video games have come to be seen as one path towards these more immersive online worlds.

The biggest tech companies have powerful incentives to take the next step and develop full gaming operations, says Michael Wolf, a media consultant. “Every one of these [tech] companies knows gaming is going to be a growth area, and it ties into their metaverse ambitions more broadly.”

With the virtual worlds of games expanding to become venues where players can do things like make purchases or watch movies, “everything you do in the real world you will be able to do inside games,” Wolf adds.

If Wolf is right, then gaming is set to become a key battleground for tech companies that want to maintain their central role in the digital lives of billions of users.

Industry scepticism

The spasm that passed through the stock market after the deal was announced suggested many investors agreed that something significant was afoot. The share prices of other big games publishers jumped on speculation that they would seek deals to get bigger, or that they would align themselves more closely with powerful games distributors in the same way Activision is doing with Microsoft. Sony tumbled 13 per cent on worries that it might have just been outflanked.

But the market shock soon faded. Sony’s shares recovered some of their lost ground within 24 hours, and the bounce in other video game stocks was modest when set against the price declines most have experienced as the pandemic has waned.

The market’s immediate assumption that the deal would trigger a wave of consolidation is a simplistic response, says an executive at one of the largest video game publishers. “You know what makes life interesting?” this person adds. “It doesn’t ever usually work out that way.”

Other industry watchers suggest the deal only represents an intensification of the competitive battle already being waged between Microsoft’s Xbox and Sony’s PlayStation, rather than a harbinger of a bigger upheaval ahead. Its main impact might well be “a rebooting of the console wars, rather than a switch away from console wars to a more general war on multiple platforms,” says Pelham Smithers, a longtime games industry analyst.

Yet, even if the analysts’ scepticism proves correct and it does not turn out to be the starting gun for a broader reshaping of the industry, Microsoft’s move has still highlighted the rising stakes in a business whose $180bn of annual revenue in 2021 is already double that of the movie industry.

Games like Activision’s Call of Duty, World of Warcraft and Candy Crush now attract hundreds of millions of players between them. The most popular games are now being distributed through many different platforms, making them available on consoles, PCs or smartphones. And their makers have found new ways to wring money from their expanding audiences, including through advertising, in-game purchases and subscriptions.

“Fifteen years ago, you had about 200m gamers in the world and today you’ve got about 2.7bn,” says Neil Campling, tech analyst at Mirabaud Securities. “It’s become the biggest form of media.”

Call of Duty, Activision’s blockbuster franchise, has made the leap from games consoles and PCs to the mobile market, which has boomed to become as big in revenue terms as the console and PC businesses combined. Purchases made by players inside the games already account for a major part of Sony’s in-game transaction revenues, according to Damian Thong, senior analyst at Macquarie in Tokyo.

Bobby Kotick, Activision’s CEO, said when explaining the Microsoft deal, that this proliferation of platforms and new forms of distribution had made it difficult even for companies as big as his to keep pace with the technology requirements of today’s gaming market.

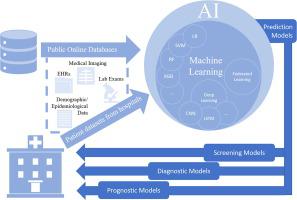

Some of the biggest tech companies already have significant stakes in the gaming world, even if they haven’t pushed far into trying to produce games themselves. These include the Apple and Google mobile app stores, which act as the main shop front for the single largest segment of the gaming market. Amazon’s Twitch and Google’s YouTube attract mass audiences for viewing video games. And through its Oculus headsets, Facebook holds the lion’s share of the nascent virtual reality market.

Meta Platforms — the name adopted by Facebook to reflect its new focus on the metaverse — was one of the companies approached by the Activision camp to see if it wanted to explore a purchase, according to one person familiar with the discussion.

Kathryn Rudie Harrigan, a Columbia University professor, describes Microsoft’s move on Activision as a pre-emptive strike to wrest the lead away from Meta in building the first iterations of the metaverse. “Facebook has stolen their thunder” with its move into virtual reality, she says, so buying Activision would give Microsoft a chance to at least “get its nose in the tent” ahead of Facebook.

Regulators and rivals

The biggest tech companies also have the deepest pockets to make the big bets now being placed in the gaming industry. Even for a company as large as Sony, buying Activision would have been a stretch, accounting for more than half of its $145bn stock market value.

By contrast, the purchase price represented only 3 per cent of Microsoft’s value, and less than its latest annual operating cash flow. That made the huge deal little more than a “tuck-in” acquisition — albeit a sizeable one — to bolster a business that most Microsoft investors hadn’t even viewed as core to the company’s future.

The deal is expected to be subjected to intense scrutiny by regulators that could take 18 months — and with both Google and Facebook on the receiving end of antitrust complaints from the US government, other acquisitions by Big Tech might now be politically impossible. Also, early attempts by Google and Amazon to create games studios of their own have failed to make a dent, putting them far behind Microsoft, which had already built a sizeable games studio business in the two decades since it launched its Xbox console.

Microsoft faces powerful opposition from bigger rivals in the gaming industry. Tencent, the Chinese company that leads the industry with gaming revenue in 2020 of $30.6bn, is widely seen as a model for the future of gaming in other parts of the world, combining mobile games and messaging to reach a massive audience inside China. And Sony, though briefly put in the shade by news of the Activision deal, has also ploughed into mobile gaming and is working on a subscription service as it looks to extend its reach into new markets.

As today’s leading gaming companies jostle for position, the most immediate impact from the Microsoft deal will be felt in the console market. After losing out in terms of sales and users to Sony’s PlayStation in the past two generations of games consoles, buying Activision could boost its access to the exclusive games that help to drive higher console sales.

Recent production problems that have weighed on the PlayStation may have given Microsoft extra incentive to make a grab for Activision as it tries to overtake its longtime rival, according to Smithers.

If so, then it would add to the opportunistic nature of the acquisition. Activision’s struggles to overcome pervasive workplace sexual harassment claims damaged its stock price and led to calls for a change in leadership last year, opening the way for Microsoft’s offer.

Although the console rivalry provides a strong incentive for the acquisition, it is in newer, growth markets that the deal’s impact could eventually be felt most keenly. Adding more exclusive content could boost Microsoft’s budding subscription service, Game Pass, which already has 25m customers. And, according to Nadella, the deal would put Microsoft in a stronger position to deliver games to mobile users in emerging countries, opening up big new markets.

For now, at least, Microsoft has tried to stamp out speculation that the pursuit of new services and audiences will lead it to keep more Activision games as exclusives — in the process, withholding them from rival platforms. Phil Spencer, head of its games business, tweeted this week that he had personally assured Sony executives of Microsoft’s “desire to keep Call of Duty on PlayStation”.

Given the scrutiny of the regulators, such assurances make sense. “Activision and Microsoft do not want to create the idea in regulators’ minds that they are going to [form] a closed shop,” says one large, long-term Sony shareholder.

With the subscription business still only representing a small part of the games industry’s revenues, turning Call of Duty into an exclusive to feed Microsoft’s Game Pass service would not make economic sense, say financial analysts. Microsoft would have to add 5m subscribers to make up for sales it would lose if it took Call of Duty away from the PlayStation, estimates David Gibson, senior analyst at MST Financial.

Considerations like these make it likely that Microsoft won’t do too much to rock the boat in the near term. But as it reaches for a big new global audience, the gaming industry’s long-term structure looks to be very much in play.

Additional reporting by James Fontanella-Khan in New York, Anna Gross in London and Patrick McGee in San Francisco