U.S. Banks Turn to Technology Providers to Transform Business, Compete Against FinTechs

ISG Provider Lens™ report sees traditional banks facing competition from digital financial services providers and increasing customer demand for digital services

STAMFORD, Conn., January 12, 2022--(BUSINESS WIRE)--The U.S. banking industry has accelerated its digital transformation over the past year in response to the COVID-19 pandemic, and banks are looking to technology service providers to help them navigate the new business environment, according to a new report published today by Information Services Group (ISG) (Nasdaq: III), a leading global technology research and advisory firm.

The 2021 ISG Provider Lens™ Digital Banking Services Report for the U.S. finds banks embracing digital services to enhance user experiences and to compete with the emerging FinTech industry. At the same time, the U.S. banking industry is seeing a growth in profits due to increased consumer savings and narrowing credit losses.

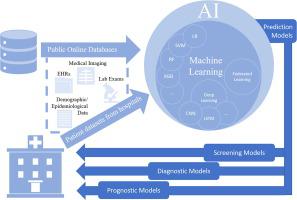

Banks are adoption emerging technologies such as mobile banking, artificial intelligence, blockchain, contactless payments, open banking and cloud computing to transform their front- and back-office operations, the report says.

"We’re confident that technology spending by the banking industry will continue in areas such as loans, wealth management, real-time payments and banking from anywhere," said Owen Wheatley, lead partner for banking and financial services with ISG. "Traditional banks need to use technology to compete with neo-banks or digital-only banks that are offering higher interest rates, transparent fee structures and flexible underwriting policies."

The report sees a changing mindset from both banking customers and industry executives, with a shift from branch banking to anywhere banking. Branch networks are undergoing a drastic transformation, redesigned to reflect persona-based hyper-personalization. There is an immediate demand for front-end automation emphasizing enhanced user experience, with interactive bots taking center stage.

Digital banking transformations can take a long time and demand considerable investments, the report adds, and banks should consider future needs, scalability and agility when engaging with digital banking providers. Digital banking transformation is not as easy as switching off the old system and switching on the new system, the report says, and hurdles to core banking modernization also include the inherent legacy complexity associated with data migration and integration and regulatory compliance.

While platform vendors and the banks have a thorough knowledge of the functional aspects of the banking system, they often lack the underlying technology expertise to undertake the transformation, the report says. Banks tend to rely on an implementation partner’s ability to analyze existing systems and create a roadmap for the future state of the underlying system.

Service providers examined in the report have invested in several new capabilities, including a combination of functional and technical expertise, allowing them to customize components for banking customers, the report says.

Systems integrators are becoming well versed in needed technologies, giving them the edge in implementations, the report adds. In some cases, systems integrators partner with multiple core software providers, enabling them to gain experience in handling different systems. This allows them to serve in an advisory role, enabling smoother transformations for banks.

The 2021 ISG Provider Lens™ Digital Banking Services Report for the U.S. evaluates the capabilities of 28 providers across four quadrants: Core Modernization and Integration Services; Banking Governance, Risk and Compliance Services; Transformational and Digital Banking Services, and Payment and Card Processing services.

The report names Accenture, Cognizant, Infosys, TCS and Wipro as Leaders in all four quadrants and Capgemini and HCL as Leaders in three quadrants. Atos and Deloitte are named as Leaders in two quadrants, and DXC Technology, EY, FIS, Fiserv, IBM and PwC are named as Leaders in one.

In addition, LTI was named a Rising Star—a company with a "promising portfolio" and "high future potential" by ISG’s definition—in all four quadrants.

A customized version of the report is available from Infosys.

The 2021 ISG Provider Lens™ Digital Banking Services Report for the U.S. is available to subscribers or for one-time purchase on this webpage.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only service provider evaluation of its kind to combine empirical, data-driven research and market analysis with the real-world experience and observations of ISG's global advisory team. Enterprises will find a wealth of detailed data and market analysis to help guide their selection of appropriate sourcing partners, while ISG advisors use the reports to validate their own market knowledge and make recommendations to ISG's enterprise clients. The research currently covers providers offering their services globally, across Europe, as well as in the U.S., Canada, Brazil, the U.K., France, Benelux, Germany, Switzerland, the Nordics, Australia and Singapore/Malaysia, with additional markets to be added in the future. For more information about ISG Provider Lens research, please visit this webpage.

A companion research series, the ISG Provider Lens Archetype reports, offer a first-of-its-kind evaluation of providers from the perspective of specific buyer types.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading global technology research and advisory firm. A trusted business partner to more than 700 clients, including more than 75 of the world’s top 100 enterprises, ISG is committed to helping corporations, public sector organizations, and service and technology providers achieve operational excellence and faster growth. The firm specializes in digital transformation services, including automation, cloud and data analytics; sourcing advisory; managed governance and risk services; network carrier services; strategy and operations design; change management; market intelligence and technology research and analysis. Founded in 2006, and based in Stamford, Conn., ISG employs more than 1,300 digital-ready professionals operating in more than 20 countries—a global team known for its innovative thinking, market influence, deep industry and technology expertise, and world-class research and analytical capabilities based on the industry’s most comprehensive marketplace data. For more information, visit www.isg-one.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220112005733/en/

Contacts

Press:Will Thoretz, ISG+1 203 517 3119will.thoretz@isg-one.com

Erik Arvidson, Matter Communications for ISG+1 617 755 2985isg@matternow.com