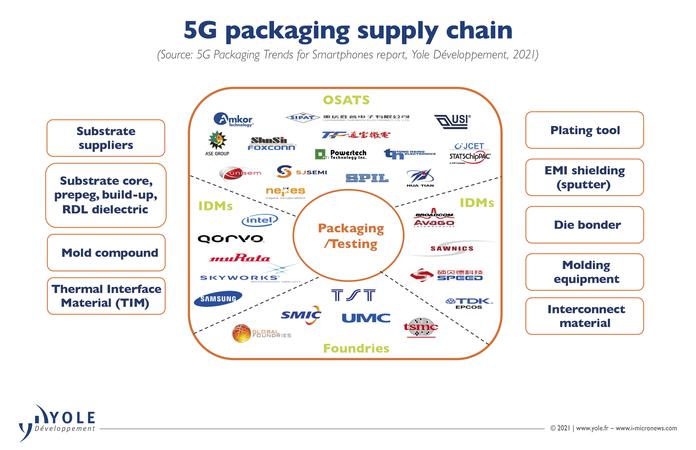

Challenges Grow For 5G Packages And Modules

The shift to 5G wireless networks is driving a need for new IC packages and modules in smartphones and other systems, but this move is turning out to be harder than it looks.

For one thing, the IC packages and RF modules for 5G phones are more complex and expensive than today’s devices, and that gap will grow significantly in the second phase of 5G. In addition, 5G devices will require an assortment of new technologies, such as phased-array antennas and antenna-in-package. Testing these antenna arrays remains an issue with 5G.

Today’s wireless networks are based on the 4G standard, which operates from the 450MHz to 3.7GHz frequency bands. In today’s 4G smartphones, the RF components are housed in an RF front-end module, which handles the amplification of the signal and filters out the noise. The antenna, which is used to transmit and receive radio signals, is separate and not bundled in the module.

The big change occurs in fifth-generation wireless networks, or 5G, which is a new wireless technology with faster data rates than 4G. Initially, some carriers are deploying 5G networks at sub-6GHz frequencies. In these 5G smartphones, the RF front-end module architectures resemble today’s 4G phones.

Some telecoms in the U.S. already are deploying a faster version of 5G using millimeter-wave (mmWave) frequencies at 28GHz. The first deployments are mainly limited to fixed-wireless home services. But if or when the service is ready on a wider scale, 5G mmWave phones will consist of new RF front-end module architectures with integrated antennas.

Besides modules, the industry also is developing new IC packages for 5G mmWave. These packages combine an RF chip and the antenna in the same unit, which is called antenna-in-package. The idea behind these new integrated antenna schemes is to bring the RF chips closer to the antenna to boost the signal and minimize the losses in systems.

Chips running at mmWave frequencies and integrated antennas aren’t new, but bringing these and other technologies over to 5G presents some challenges. Unlike 4G, 5G mmWave systems incorporate phased-array antennas, which consist of an array of antennas with individual radiation elements. A phased-array antenna can electrically steer a beam in multiple directions using beamforming techniques.

There are other issues for 5G mmWave. “The rollout is going to take awhile,” said Jan Vardaman, president of TechSearch International. “In 5G, the problem is that it operates at higher frequencies. All of your packages have to be geared to deal with higher frequencies. When people talk about millimeter-wave frequencies, it’s not only the packaging, but it’s the test that goes with it. How do you test at these frequencies? In addition, you will need special things. You will see antenna in package. You will see a boatload of filters.”

Today, several companies are developing IC packages and RF modules for 5G mmWave. Among the developments:

Figure 1. BGA with antenna in package for 5G mmWave. Source: ASE

Figure 2. ASE’s fan-out with antenna in package for 5G. Source: ASE

What is 5G?

In 1991, carriers launched a new cellular technology called 2G, followed a decade later by a more advanced version known as 3G. 2G had four frequency bands, while 3G had five. Cellular networks consist of a range of frequencies in the RF spectrum.

Today, wireless networks revolve around the 4G LTE standard, which provides faster data rates. 4G is also more complicated, as it consists of more than 40 frequency bands, plus the 2G and 3G bands.

After 5G is deployed, 4G won’t going away. In fact, it will remain the mainstream wireless technology for some time. By 2024, 4G LTE is expected to have more than 6 billion subscribers, representing over two thirds of all wireless users, according to Strategy Analytics.

5G is emerging and initially will co-exist with 4G, but eventually it will evolve into a standalone network. Compared with 4G, 5G promises to deliver mobile network speeds with a 10X lower latency, 10X higher throughput and a 3X spectrum efficiency improvement. Besides faster mobile broadband, 5G enables faster communications on the manufacturing floor, in businesses, as well as in vehicles.

As of June, 5G has been deployed by 15 mobile network operators worldwide, according to 5G Americas. There will be an additional 47 launches by year’s end, according to the organization.

“The global 5G smartphone rollout so far is slightly faster than expected,” said Neil Mawston, an analyst with Strategy Analytics. “Heavy carrier subsidies in South Korea have seen 5G smartphone sales jump quickly to over 1 million units this quarter. The U.K. and U.S. are surprisingly buoyant, while China has brought forward some of its network launches. However, it is not all rainbows and unicorns. Japan has been surprisingly slow to launch 5G networks and smartphones and is lagging badly.”

On the mmWave front, the United States has approved 28GHz for 5G, while mmWave is moving forward in Europe, South Korea and elsewhere. “We expect 5G mmWave smartphones to emerge in reasonable global volumes from 2020, led by the introduction of Apple’s iPhone 5G,” Mawston said.

The 6GHz version of 5G resembles 4G. 5G mmWave is different and more complex. The 5G infrastructure starts with a core network, which handles mobile voice and data connections.

It also involves a series of base stations and cell towers, which incorporate multiple antennas, sometimes called multiple input, multiple output (MIMO) antennas. In simple terms, the base stations send signals to smaller cell units or smartphones using a technology called beamforming.

There are several challenges here. “Many think mmWave is a technology searching for a problem,” Mawston said. “Millimeter wave has a line-of-sight requirement, low penetration capabilities through walls and a fairly short range. Some say mmWave is more suited to a portable or fixed environment, and not ideal for mobile smartphones. Historically, mobile technologies that struggle to penetrate walls inside buildings like Zigbee have failed to take off in smartphones. Consumers and workers like to move from room to room or office to office and not get disrupted coverage.”

The network is complex in other ways. “Millimeter waves don’t travel very far. We need a much finer mesh so that mobile devices can access the data. The mesh will be the last mile connection,” said Ajit Paranjpe, CTO of Veeco. “The backhaul will bring data to locations near the home. From there, mmWave transmission could connect to the mesh.”

It remains to be seen if 5G mmWave will succeed or fail—or fall somewhere in between. It may work in some areas, but not in others. “The network for the U.S. is going to be a challenge,” said Kim Arnold, executive director at Brewer Science. “When they say that 5G is line-of-sight, that’s going to become a big challenge in less populated areas. We may see it in cities.”

Inside the smartphone

The first 5G smartphones resemble today’s 4G phones. 4G phones incorporate digital chips and RF components. In 4G, the main antenna is separate and runs alongside the phone.

The digital part consists of a modem. The RF components include a separate RF transceiver and an RF front-end module. The transceiver transmits and receives RF signals.

The front-end module consists of several components in the same unit, including power amplifiers, low-noise amplifiers (LNAs), filters, and RF switches. Power amps provide the power for a signal to reach a destination. LNAs amplify a small signal, while filters block out the noise. Switch chips route signals from one component to another.

In the module, the dies are sometimes put in IC packages. Typically, though, they are bare dies that reside on a board.

4G phones also consist of other RF chips, such as Bluetooth and WiFi. 5G smartphones also will use those RF devices. Generally, those devices are housed in packages with integrated antennas, which saves board space.

Today, LG, Samsung and others are rolling out the first 5G phones, which support sub-6GHz, not mmWave. Generally, the initial 5G phones will have a similar RF front-end module architecture as 4G systems.

When the industry rolls out 5G mmWave phones, though, the RF front-end module will change. In 4G, for example, the transceiver is a standalone device. “It’s typically a packaged IC separate from PA, filters, duplexers, switches, related front-end modules,” said Christopher Taylor, an analyst with Strategy Analytics. In 5G the transceiver, along with the antenna, will move inside the module.

But mmWave itself isn’t new. For example, some cars make use of mmWave radar chips operating at 77GHz. Radar chips are used for lane detection and other safety features in cars.

Radar chips are housed in different package types, such as BGA and fan-out. BGA is a common surface mount package. In fan-out, the dies are packaged on the wafer. “In fan-out, chips are embedded inside epoxy molding compound and then high-density redistribution layers (RDLs) and solder balls are fabricated on the wafer surface to produce a reconstituted wafer,” explained Kim Yess, technology director at Brewer Science, in a blog.

There are several packaging approaches for radar chips. “If you look at an automotive radar system, the transceivers and receivers are packaged in a fan-out wafer-level package. In some cases, it’s a flip-chip package. In other cases, it’s a bare die on a board,” TechSearch’s Vardaman said. “The antenna is on the board, but that’s in the car where there is a lot of space. They are like modules.”

But in 5G mmWave phones and other systems there are different requirements, including smaller form factors with integrated antennas in the module or package. The goal is to not only save space, but also to bring the antenna closer to the RF chips.

“Once your signal is up into the mmWave frequency range, you want to keep the signal traces to and from the antenna as short as possible to avoid losses,” Strategy Analytics’ Taylor said. “You also ideally want to have the same parasitics and distance to and from each antenna element in a patch antenna. Otherwise, performance will differ for each element. The question is how do you do this?Qualcomm and others are using multiple die and stacking everything in a package, with short distances between the transceiver and beamforming components, and antenna elements.”

Developing antenna technologies for 5G mmWave is challenging. “A lot of it goes back to what frequency or spectrum you are dealing with,” said Mark Gerber, director of engineering and technical marketing at ASE. “The lower the frequency, it generally requires a larger antenna. The higher the frequency at the mmWave, you are going to have smaller antennas. Because it’s a smaller antenna, it needs to be very precise.”

That’s not the only consideration. “That requires some specialized antenna designs. It’s not just one antenna, but generally multiple antennas. It’s not just one plane, but you need multiple planes,” Gerber said.

5G is poised to dominate the wireless world, but over-the-air (OTA) testing of 5G beamforming antennas is still not ready for volume production. In 5G mmWave, the antenna array is integrated. There are no probing points to do the measurements, thereby requiring OTA. “A typical OTA test solution includes a chamber enclosure, probe antennas (and link antennas for tests requiring an active call), and test equipment to generate and analyze the radiated signals in a spatial setting,” according to Keysight.

“At first there were a lot of concerns about OTA and how to handle that,” said David Hall, chief marketer at National Instruments. “Lab-based OTA test systems has become fairly widespread, but the current methodologies used in the lab environment do not scale to the cost and speed expectations of the manufacturing floor. As a result, NI continues to investigate both near-field and far-field approaches to OTA testing in preparation for delivering OTA-based manufacturing test solutions in the future.”

mmWave packages and modules

At some point, OTA will get resolved. Then, to complicate matters, integrated antennas can be developed in a variety of ways, such as antenna on board and antenna in package, among others.

In one example, Qualcomm recently introduced a 5G RF front-end module, which includes a mmWave antenna unit. Geared for 5G smartphones sleeker than 8mm thick, the module supports band n258 (24.25 to 27.5GHz) for North America, Europe and Australia on top of bands n257 (26.5 to 29.5GHz), n260 (37 to 40 GHz) and n261 (27.5 to 28.35GHz).

Qualcomm’s product combines the RF front-end module and antenna in the same unit. The module interfaces with Qualcomm’s 5G modem chipset. “Inside the antenna module, there is an antenna array and all front-end components, including PA and LNA,” said Alberto Cicalini, senior director of product management at Qualcomm. “Qualcomm has the antenna on a separate substrate.”

Figure 3. Qualcomm’s mmWave antenna module. Source: Qualcomm

Qualcomm is integrating the antenna within the RF module. The antenna itself is placed on a board, sometimes called antenna-on-board.

The technology solves a major problem. “Millimeter-wave is very hard to use. The path loss is typically a factor of a 100 or more than what you would have in traditional bands for cellular,” said Jim Thompson, vice president of engineering and CTO at Qualcomm, in a recent presentation. “With mmWave, the wavelength is less than a centimeter. So it’s very small and it’s subject to blockage.”

To solve the problem, smartphone OEMs will integrate several mmWave antenna modules inside a phone. “With your hand, you might block one of the antennas,” Thompson said. “So what most of our customers are doing is using three different antennas. They are typically putting them on upper right, upper left and the top of the phone.”

In operation, a 5G base station with a MIMO antenna unit would direct beams in multiple hot spots in a space. The phone would receive and transmit signals via the MIMO unit.

Still to be seen, however, is whether it will work in the field. That’s not the only challenge. “In addition, 5G mmWave systems create significant challenges for packaging engineers, since the power consumption caused by the high data rates at mmWave is coming from the active device. The thermal issues of the interface on the PCB is a very serious challenge to 5G millimeter-wave systems,” said ASE’s Sheng-Chi Hsieh in a recent paper.

In that paper, ASE described a different approach to 5G. It has developed a fan-out packaging technology using an antenna-in-package approach for 28GHz 5G.

Antenna-in-package is different than antenna-on-board, where the antenna is placed on the PCB. With antenna-in-package, the idea is to integrate an RF chip and the antenna in the IC package. The goal is to the shorten the connection between the die and antenna to boost the electrical performance, according to ASE.

In the paper, ASE compared fan-out versus a flip-chip BGA package using various antenna in package schemes for 5G mmWave. In the BGA example, an RF chip (mmWave transceiver) is mounted on the bottom of a substrate. Then, the antenna array is formed on top of the substrate with a through-hole design. In some cases, the industry refers to this as a patch antenna.

There are some challenges with flip-chip BGA using an organic substrate. “The thick substrate is not easy to mount in the thin mobile phone case,” Hsieh said.

For its part, ASE has developed a hybrid fan-out package called Fan-Out Chip On Substrate for 5G mmWave. “Fan-out offers a small form factor, excellent electrical and thermal performance for mmWave antenna-in-package into mobile devices,” Hsieh said.

It appears ASE took a different approach for the antenna-in-package design. The technology involves two separate pieces—a substrate and an antenna module.

The bottom piece is a substrate. An RF chip resides on top of the substrate. The top piece is the antenna module. Then, the antenna module is mounted on top the substrate and connected using copper pillars.

Instead of a conventional antenna patch design, ASE devised a stacking patch. Traditional patch antennas have a narrow band. A stacked patch boosts the bandwidth in the system.

All told, ASE’s 5G fan-out package is less than 0.75mm with three RDLs. It demonstrated better than a 10dB return loss in the 26 to 33GHz range with ~7GHz bandwidth. It provides a high-gain above a ~10.3dBi radiation pattern with a 2×2 patch antenna array.

From a manufacturing point of view, meanwhile, antenna-in-package is a straightforward process. “Conventional bumping processes are typically used for mounting the RFIC chip to the AiP (antenna-in-package) module,” said Warren Flack, vice president of worldwide applications at Veeco. “For some implementations, this may require an additional RDL layer in the RFIC chip for connecting the RFIC chip to the circuit board based AiP module. The RDL line sizes are not challenging for current advanced packaging lithography.”

There are some challenges, however. “5G is going to rely on higher levels of integration for advanced packaging – whether the 5G network utilizes sub6-GHz frequencies or mmWave,” said Stephen Hiebert, senior director of marketing at KLA. “More complex integration drives tighter quality requirements for the various components that are integrated in the SiP.Accurate inspections at the wafer, die and sub-package level are critical for determining the known good components for the SiP schemes being deployed for sub6-GHz 5G. For mmWave 5G, fan-out packaging is being explored as an option for antenna, so additional inline process control using inspection and metrology will be essential to achieving yield requirements.”

Meanwhile, antenna-in-package is moving in other directions. It also may find its way into short-range 77GHz car radar devices.

In a recent paper, Siliconware, now part of the ASE Group, described a flip-chip chip-scale package with an embedded trace substrate (FC-ETS) technology for 77-GHZ radar devices. SPIL also uses antenna in package.

“Compared to conventional antenna-on-PCB board designs, land-side die structures can achieve a shorter path from chip output to antenna input, and reduce the transmission loss of the high-frequency signal,” said Tom Tang from Siliconware in the paper.

Clearly, 5G is finally happening after years of R&D. Even mmWave is ready, at least in limited form. Still to be seen, however, is whether the technology can live up to the hype.

Related Stories

Where 5G Works, And Where It Doesn’t

5G Driving New Automotive Applications

5G OTA Test Not Ready For Production

Edge Complexity To Grow For 5G

5G Heats Up Base Stations