Blockchain data platform leader issues warning amidst surge in cryptocurrency crime

A comprehensive report compiled by blockchain-based data platform company Chainalysis has illustrated concrete evidence that the surge in demand for NFTs has triggered the attention of cybercriminals, who we know are well accustomed to following ‘the noise’.

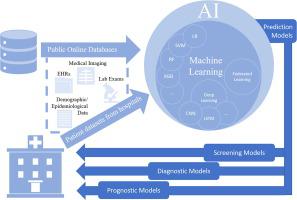

Since its inception in 2014, Chainalysis has enjoyed phenomenal success and provides cryptocurrency exchanges, international law enforcement agencies and other clients with blockchain transaction analysis software to help them comply with regulations, assess risk, and identify illicit activity.

CNME managed to secure an exclusive interview with Kim Grauer from Chainalysis, to explore in more detail how NFTs are being used for illicit activities.

The report conducted by Chainalysis found that there was a significant amount of wash trading happening when it came to NFT marketplaces – and Grauer kickstarted the conversation by explaining what exactly wash trading is.

“Wash trading is something we hear all about in the crypto space, and it is basically purchasing your own asset to artificially inflate the demand of that particular asset. For example, say I launch an NFT, but nobody is buying it, I then proceed to fake demand by buying my own NFT to make it seem like there is a lot of hype around that NFT, in the hope then that this leads to someone believing this hype and buying the NFT”, said Grauer.

Wash trading is not a new concept in the cryptocurrency industry, but as Grauer pointed out in the past people were unable to gauge how much of it was happening until Chainalysis entered the fray.

“We’ve heard about wash trading in the crypto space for a long time, however, it has never been possible, or nobody has been able to estimate accurately the amount of wash trading that is happening. Some analysts will claim that 90% of order book volumes are wash traded, but there is very little evidence to back that claim up. However, our approach is the first real data-driven attempt to demonstrate wash trading happening with NFTs”, said Grauer.

Interestingly the research director revealed that contrary to what people would expect, it is not that profitable to wash trade NFTs because of the excessive cost of transaction fees – and explained how they use their technology to track it.

“You can identify wash trading on the blockchain by just looking at did the person who purchased the NFT on the platform receive the money from the person who was selling the NFT on the platform. What we witnessed from the population of people who exhibited this behaviour was that the majority didn’t make money in this effort, quite simply because they spent more on transaction fees than they received from people who were falling from this scam. One person that we really looked at attempted to wash trade their asset 800 times, but that cost him around $32,000 on transaction fees, but he only received $27,000 from people who were victims. There was a smaller population that did make money, and a few of them did make a lot of money, but it’s still a big risk”, said Grauer.

Grauer added that the people who are engaging in this activity are plugged into the space, and probably have a better sense of what types of NFTs to pump, but stressed it still is going to be a big risk.

In terms of what has really triggered the explosion in interest, demand, and investment in NFTs, Grauer said it was a combination of the fear of missing out on something big, and the philosophical offerings of some NFTs resonated with many potential investors.

“I think the interesting thing about NFTs is the potential for disruption because it represents this new digital concept of property. You get the feeling that this is going to be big, but you don’t quite know why it’s going to be big. I believe that the more philosophical offerings of NFTs are extremely attractive to people, and this could really disrupt how we manage things. I think any space that grows very fast will see people come in and make a bid to make sure they do not miss out on the opportunity, so it explodes faster because investors do not know what is going to happen, but they don’t want to miss out on it. The hype has gone up and we have got a lot of people onboarded into the industry, and now we need to put our money where our mouth is. We need to make these killer applications for people, so a lot is dependent on what comes from these developers and big businesses”, said Grauer.

The software deployed by Chainalysis has helped law enforcement agencies uncover some of the internet’s darkest underbelly, and Grauer explained how they equip agencies with the tools they need to uncover this type of incognito crime.

“We invest the bulk of our resourcing into identifying services, and we have experts in many crime areas. We have an expert in human trafficking and child abuse materials and dark net marketplaces, and they work to make sure that our data platform has all the best data – and is in partnerships with the right people. We enable law enforcement agents to see transactions from human trafficking wallets and then we come in and provide data and investigative support as well.We work with crypto currency businesses, financial institutions, government agencies and law enforcement, and each of them has a different data need and we fill their data need with a different product. For example, with law enforcement we’ll provide them with investigative products, whereas financial institutions we give them compliance products”, said Grauer.

In terms of what she viewed as one of the most interesting trends that emerged from their 2022 Crypto Crime Report, she cited the growth in hacking and De-Fi this year.

“A thread throughout our conversation is that all this growth comes with risk, and people are investing in platforms that have been hacked and are not secure, so there is this need to have sustainable growth where you can onboard new people sustainably in the sense that there are not going to be a victim of an attack. We saw this massive explosion of De-Fi and NFTs, but that was countered by an explosion of hacking and scamming. We are working on industry-solutions to combat that crime. A good illustration of that is the fact that some exchanges are using our software to prevent their customers from sending to known scams and that has had the impact of reducing the amount of scamming by 80%”, said Grauer.

In terms of what differentiates Chainalysis from their market rivals, the company’s research director was blunt and concise with her response, saying that she believed quite simply that they have the best data.

“We try to illustrate how we are the best in the market with our reports, but I think we really do bring the best data. We have been around since 2014, we have the best attribution, the best sense of how much crime is occurring, and we are really the best in the business in terms of our data quality, and that’s why we put out these reports, and in no small part because we need to inform people of the trends, but also because we are confident in the quality of our data. In summary, you won’t see this level of reporting in marketing materials from any of our competitors, and the reason for that is, if our rivals could then they would”, said Grauer.